Annual Reports

Goldco has a minimum investment of $25,000. Gold IRA custodians must comply with IRS rules and regulations, as well as FINRA regulations, in order to provide gold IRA services. Noble Gold is one of the most reputable companies to buy Gold online because they offer competitive prices, a wide variety of products, and a secure, easy to use website. Best Gold IRA Companies. Gold individual retirement accounts Gold IRAs let you hold gold and other precious metals in a tax advantaged way. Since a precious metals IRA deals in physical assets, you’ll also need to factor in shipping and storage costs. Gold and other precious metal IRAs are an investment and carry risk. However, there are some drawbacks to consider before investing with Augusta Precious Metals. You may withdraw funds from a Roth IRA account without paying taxes or penalties because these accounts are funded with assets that have already been taxed. You can purchase eligible gold or silver coins or bars through your IRA and have them securely stored on your behalf in a high security specialized vault. The alternative assets company handles both IRA and non IRA transactions. Advertising Disclosure: We may earn money from our partners when you click a link, complete a form or call a phone number. They will manage the paperwork and establish your account representative to create the paperwork for your new IRA.

Trading hours

You can hold four types of precious metals in your gold IRA: silver, gold, platinum, and palladium. Here’s what you should look at when choosing a gold IRA company. Having a backup plan while you build your wealth is always better. You can learn more by reading our guide on how gold IRAs work. Discover Financial Freedom with Lear Capital. You’ve probably heard of 401k and traditional IRA accounts. Everyone’s financial situation and retirement goals are different, and it’s crucial to speak to a financial advisor to see whether a gold IRA is a smart investment for your needs. Noble Gold has exceptional customer service, while Hartford Gold has a simple and transparent fee structure. Like a traditional IRA, employer contributions are tax deductible. $50,000 here minimum investment. You can even purchase precious metals from Augusta and store them outside a gold IRA for your personal collection. Whether you are looking to diversify your retirement portfolio or just want to start investing in gold, the American Hartford Gold Group has the gold investments you need to make the most of your IRA. Furthermore, Silver Gold Bull allows you to establish multiple precious metals accounts, granting you the flexibility to tailor your investment strategy to your unique needs.

8 Advantage Gold: Best for Silver IRA Rollovers

The founder of Noble Gold Investments has many connections within the gold and precious metals industry, allowing the company to offer competitive pricing on gold, silver, platinum, and palladium from across the world. According to the representative we spoke with, there is a $325 fee for the first year and a $180 annual fee for each year after that. Their website is easy to use and offers helpful information on how to get started investing in gold for your retirement portfolio. 5 years, both types of account allow the IRA holder to withdraw the funds without any penalty. Here are a few reputable resources that can help you find the best gold company reviews. Invest In Gold With Oxford Gold Group Today. Founded in 2006, Goldco’s cache comes from many well known supporters, listed on the website.

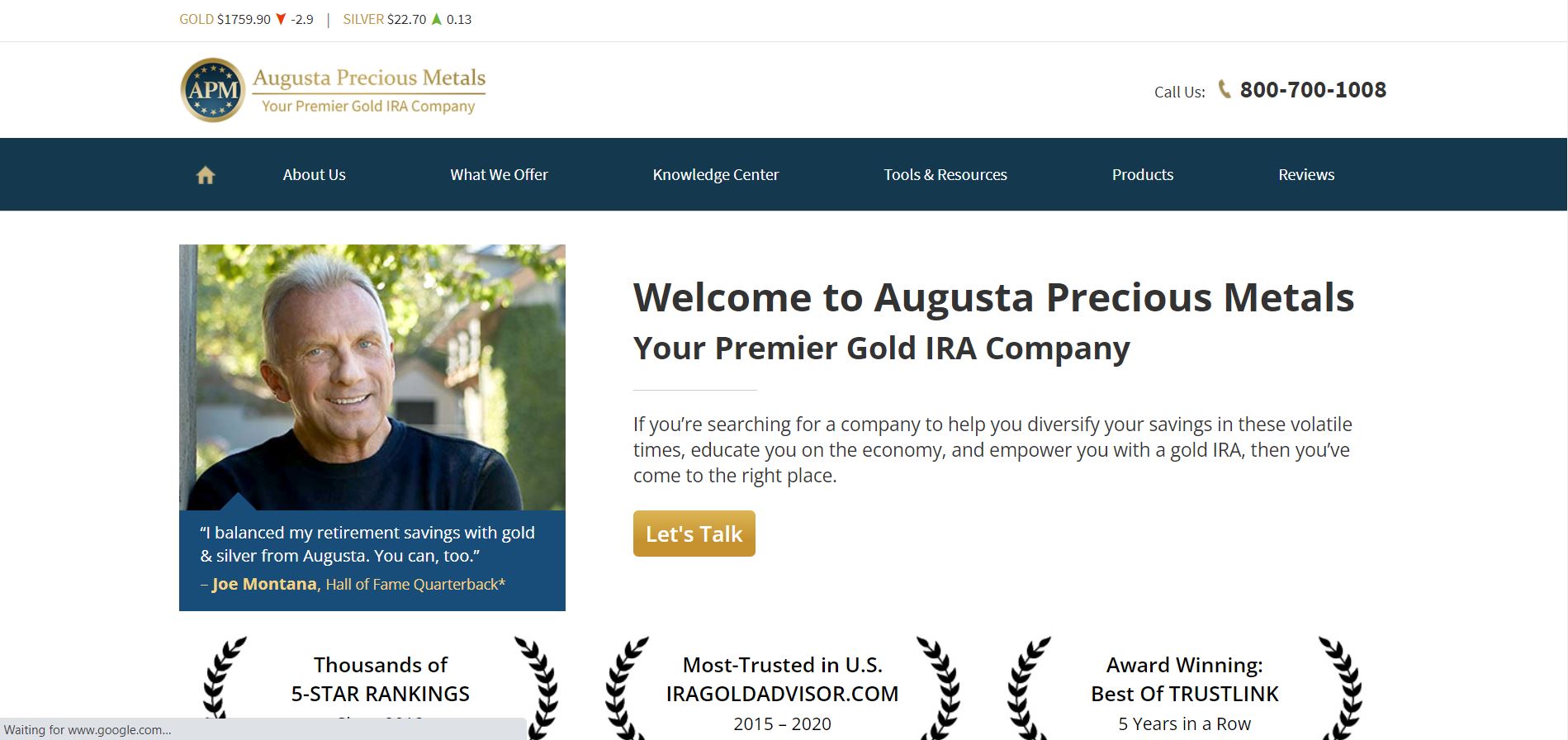

12 Augusta Precious Metals: Best for High End Metal Investments

While we are independent, the offers that appear on this site are from companies from which finder. While these transactions are subject to tax and withdrawal regulations, a reputable gold IRA company should efficiently handle the processes with minimal complications for the investor. Gold is stored in an external secure depository or home safe or bank safe deposit box. The Gold Ira Company specializes in Self Directed IRA accounts that can hold eligible gold, silver, platinum, and / or palladium physical precious metal bars and coins. From fascinating gold coins to diversifying your retirement and asset holdings with gold, our free kit explains the options you have using gold to potentially safeguard your savings. And was also endorsed by the talk show host and conservative political commentator Sean Hannity and American radio personality Stew Peters. Perhaps it’s that intention of customer prioritization that is responsible for so many positive reviews in the first place.

2 Red Rock Secured: Most Expierenced

Texas is home to large reserves of gold, silver, and other physical precious metals as a giant oil magnate. As we culminate this extensive evaluation of gold IRA companies, you may rest assured that you could look to any of the contenders we studied today and be confident you’re making a worthwhile investment. Each company asked for a name, email, and phone number to enter a live chat, but we found all company representatives very responsive and knowledgeable, answering all of our questions in full. In addition, the Technical and Miscellaneous Revenue Act of 1988 allowed IRA owners to invest in state minted coins so long as they are held in the possession of the IRA holder. Augusta Precious Metals has earned its reputation as one of the top gold IRA companies due to its customer service and transparency. For these reasons, investors continue to look to gold as a relatively safe investment option and protection against risk. But despite the risk, Moy says there is a reason to invest some of your retirement funds in the yellow stuff. Augusta Precious Metals offers a wide selection of gold, silver and other precious metals, as well as exceptional customer service and secure storage options. Their customer service representatives are friendly, knowledgeable and always willing to answer any questions customers may have.

Advantage Gold: IRA Accounts Gold IRA Custodians

Get matched with a financial advisor who fits your unique criteria. Secure Your Wealth with American Hartford Gold Group Invest in Gold Today. This free investors kit will explain everything you need to know about gold IRA investing. It uses STRATA Trust Company and Equity Trust Company as gold IRA account custodians, and Brink’s Depository and Delaware Depository vaults. As an established precious metals specialist, Lear Capital offers a wide range of bullion, including silver, gold, palladium, and platinum coins and bars from mints across the world. Regal Assets have the overall lowest fees both admin and storage fees out of any company that we’ve reviewed. These depositories are located in select retail locations and offer secure storage options for precious metals.

Related Articles About Gold and Silver IRA

Relatively newer platform. Several online resources provide ratings and reviews of precious metals IRA companies, which can be useful in evaluating their reputations and legitimacy. Gold coins and bars are required to be a minimum of 99. All of that remains the responsibility of the client and whichever broker they have chosen to handle the purchasing of gold and other precious metals. This gold investment company also offers competitive pricing and a wide selection of products that make it a great choice for any IRA gold investment. An IRA gold investment is a great way to diversify your retirement portfolio. Mint, the corresponding agency of certain other countries, or designated private minting companies, can be held in a gold IRA. Among the top contenders in the industry are Augusta Precious Metals, American Hartford Gold, Oxford Gold, Lear Capital, GoldCo, Noble Gold, Patriot Gold, Gold Alliance, Advantage Gold, Birch Gold, RC Bullion, and GoldBroker. This depends upon your investment strategy, risk tolerance, and proximity to retirement. All the firms we reviewed offer IRS approved precious metals, including gold, silver, platinum, and palladium. With a gold IRA rollover, you can transfer funds from an existing IRA account and invest in physical gold, silver, platinum, and palladium.

RC Bullion: Cons Convert Roth IRA to Gold

Goldco does not charge any storage fees for cash transactions over $25,000. Offers SIMPLE and SEP business IRAs. Experience the Quality of Augusta Precious Metals: Invest in Value Today. Editorial Rating: 5 out of 5. Gold remains the best option to invest in, but it’s limited in pricing per ounce. Gold has long been seen as a reliable store of value and an important asset to have in a diversified portfolio. You’re going to go through some processes that are going to be unusually complex, and those who have not navigated them before will have a tough time doing so. They volunteer and donate to several charities, including Wounded Warrior Project, The Claire Foundation, A Place Called Home, and No Kill Los Angeles. Patriot’s track record of excellent customer service makes it impossible for me to not mention it so high on my list.

Silver coins

If unsure, you can also look for reviews from their verified customers on platforms like the Business Consumer Alliance and Better Business Bureau. Best Gold IRA Companies. Get started with Red Rock Secured. Including gold and other precious metals in your holdings may lower your risk by diversifying from paper assets, thus potentially hedging against the economy and inflation. There are no hidden fees. To start, you’ll have the chance to speak with a live representative who can assist you with your precious metals purchase. Their commitment to providing the highest quality service and products is unparalleled, making them a top choice for gold investments. For smaller investors, the ultra low $2,000 investment minimum and administrative fee separates Noble Gold from many higher minimum gold IRA providers. Premium Coin Analyzer. Required Minimum Distributions: If you’re over 70 1/2 years old, you must take minimum distributions each year from your traditional IRA. Augusta Precious Metals is an excellent gold investment company, their expertise in the gold market is unrivaled, with a level of customer service that is second to none. The company has served customers for over two decades and has completed over $3 billion in precious metals transactions. Gold IRA rules require that you store eligible precious metal with a national depository, a bank, or a third party trustee approved by the IRS.

What Causes Fluctuation in Gold Prices?

Silver Coins and Bars: They must have a 0. New customers at Noble Gold do not have to pay any signup fee but they are required to pay an annual $80 for account maintenance. This article contains references to products and services from our partners. Disclosure: We are reader supported. You may even qualify for free storage. In exchange for security and staying IRS compliant, you will have to pay a depository storage fee. In the second place, we have American Precious Metals, which has a history of over a decade and it’s notorious for helping clients diversify their portfolios. If you are purchasing Gold or Silver within your IRA you will need to make sure the coins or bars are all IRA approved.

May 2, 2023

You can get up to $10,000 in free precious metals with approved purchases. A gold IRA is an individual retirement account that allows you to invest in gold, silver, platinum, and palladium. Check out our Goldco review. This unique approach provides numerous benefits, including portfolio diversification, tax advantages, and asset protection. The performance of these stocks is influenced by the price of gold, so they tend to do well when gold prices rise. This ensures your information is kept confidential and protected from any unauthorized access. This is not a financial advice.

Best Gold IRA Companies of May 2023

These vehicles safeguard money to fund your retirement. When comparing different providers, consider all costs to make the best decision for your needs. Yes, the IRS wants to know about your income, so you must report any purchases of gold, silver, or other precious metals. Altogether, we highly recommend Goldco as a reliable gold IRA company. The Business Consumer Alliance awarded them with a AAA rating, and they earned an A+ qualification from the BBB. Due to the inclusion of precious metals, this account type often comes with distinct costs not associated with other retirement accounts. Call us today to find out why we are America’s Most Trusted Gold IRA Company. This business has been around since 2003, helping new investors get into silver and gold investments. An individual retirement account is one of the few retirement plans that give you full control as to how you use it. When it comes to customer service, Goldco takes great pride in offering high levels of responsiveness and reliability from start to finish. Fees: An annual maintenance charge of $180 is applicable. On top of that, your chosen company should be able to help you choose a depository. Our gold IRA reviews and our gold IRA investing guide below will help you make the right choice to diversify your portfolio, and teach you what you need to know before investing. They also promise that you will never pay retail on your precious metals.

Ranked 5 of 25

To discuss product pricing, clients are advised to contact a representative through the provided toll free number. They offer a variety of services, including gold IRA rollovers, gold IRA storage options and gold IRA transfers. Charge Set Up and Annual Fees. As mentioned above, gold has drastically outperformed market proxies like the Dow Jones Industrial Average and the SandP 500, shielding some portfolios from catastrophic losses and setting them up for gains in 2023. Investing in gold is a great way to diversify your retirement portfolio and ensure that you have a secure financial future. We hear the one on one web conference designed by their on staff, Harvard trained economist is excellent and very helpful. Depending on the type of loan, you may be able to use the funds to purchase gold or other precious metals. The process of opening a gold IRA with Birch Gold Group is fast, secure, and straightforward. The customer service at American Hartford is second to none as well – they are available 24/7 by phone or email should any questions arise during the investment process or afterwards. Precious metals IRA’s are regulated by the same tax laws and restrictions of traditional, Roth, SEP or Simple IRA plans. Opening times may change at short notice due to COVID. Patriot Gold offers gold and silver IRAs as well as an extensive selection of coins and bars.

Categories

Experience the Luxury of GoldCo and Unlock a World of Possibilities. They offer a variety of gold IRA services, including a wide selection of gold coins and bullion, and provide an easy to use online platform for gold IRA transactions. We looked at a variety of factors to choose the gold IRA stars on this list. The benefit to gold IRAs is that they can guard against inflation and offer a way to diversify your retirement portfolio. 995 purity before being invested in a self directed IRA. Foreign companies and investment opportunities may not provide the same safeguards as U. How secure your gold IRA investment will be depends on a number of factors, including who holds the account and what measures are taken to protect it from theft or fraud. Many of the custodians and brokers that open mainstream IRAs that invest in traditional assets don’t have the capacity to open and operate a SDIRA, including a gold IRA. “One key benefit of gold mining companies is they make a profit and pay dividends. With Lear Capital, you can invest in gold, silver, platinum, and palladium coins and bars in their self directed IRA or 401k retirement accounts, taking advantage of potential tax benefits and diverse investment options. They also have price protection policies to help first time gold IRA owners and investors navigate buying gold without taking on excessive risks. Then your representative will help you purchase precious metals. Companies that responded within a few days or quicker stayed on our list.

Best Gold IRA Investment Companies for 2023Best Gold IRA Investment Companies for 2023

Continue reading to learn more. Consider the product offerings of the Gold IRA company, including the range of precious metals available, the quality of the metals, and the fees associated with the account. All in all, the IRA is both a special privilege given to you by the law and a source of obligations. Since gold IRAs offer the same tax advantages as other traditional IRAs, they represent an opportunity to diversify investment portfolios while maintaining tax benefits. Fee waivers, an ample portfolio of gold coins, and a positive track record of satisfied customers, as reflected by the company’s online feedback on Trustpilot and Google Reviews, are some of the characteristics that make this provider stand out from its peers. The company’s philosophy is that informing customers of their upfront expenses helps them be better prepared for their investment journey.

Subscriptions

If you have any questions or would like to make a purchase please call us on 020 8138 0881. Experience the Best in Gold Investment with GoldCo – Start Your Journey Today. American Hartford Gold: Good for gold and silver coins. => Visit Goldco Website. This means that the custodian of the original IRA will send you a check performing a cash out for you from the previous IRA. American Hartford Gold is one of the industry’s most highly rated gold IRA companies. They are experts in gold investments, offering tailored advice and competitive fees. Secondly,your precious metals have to be housed in an approved depository like the Delaware Depository. Like gold, it has industrial uses and is a store of value. IRA amounts of $5,000 $25,000. By submitting this form you may also receive market alerts. Given all this information then it should come as no surprise that careful planning ahead is essential when considering entering into any kind of gold investment endeavor – especially with regards to understanding exactly how much money needs to be put down initially and what sorts of extra expenses could arise further down the line. Not all gold companies offer buybacks — some will buy your gold but won’t guarantee you’ll get the best price or will charge liquidation fees that increase as you sell more gold. Furthermore, you have to purchase it in one tenth ounce, one quarter, one, or one half gold coins when buying this type of asset for your precious metals IRAs.